CHINA BULLETIN: Big Ado Over Little Inflation

Welcome to the latest Bamboo Works China Bulletin, where we recap the top China macro, industry and company developments from the past week and give you our spin on what it all means. In this week’s issue the U.S. stuffs another major sock into China’s appetite for microchips, the bloodbath continues for Chinese stocks, and inflation surges – at least by Chinese standards. On a scale of 1 to 10, we give the week a 3 for offshore-listed China stocks.

Doug Young, Editor in Chief

MACRO

Big Ado Over Little Inflation

An inflation rate of 2.8% would be the envy of just about any country in the world right now. Except for China, that is. The country’s latest CPI increase for September came in at just that level compared with a year ago, representing the fastest consumer inflation since April 2020.

China has been remarkably good about controlling inflation in the last few years, even as the rest of the world has suffered with much higher rates. But the uptick, while small by western standards, is likely to create headaches for China’s central bank and financial regulators, since it could complicate their recent efforts to ease monetary policy to jumpstart the ailing economy.

Home, Anyone?

In what will come as a surprise to nobody, China’s real estate market continued to give off more distress signals last week. One of those saw 46 of 50 cities tracked in a monthly survey by Shanghai E-House post home price declines in the latest month, while another survey showed home sales slumped during the recent weeklong Oct. 1 holiday.

China has been throwing just about everything but the kitchen sink in efforts to support its housing market these days, from ordering banks to issue more home mortgages to giving money to developers to restart stalled housing projects. So far none of it is having much effect, which is probably because prices are still way too high for many Chinese to buy homes even if they wanted to.

Ouch. Another Bad Week for China Stocks

After a brief respite, China stocks returned to their losing ways big time last week. The Hang Seng China Enterprises Index slumped 7.3% during the week, while the iShares MSCI China ETF also fell 7.3%, compared with a similarly sharp 6.5% drop for the broader Hang Seng Index.

This does seem like the time that bottom fishers might start smelling a bargain and rush in to scoop up shares that seem hopelessly undervalued. The big problem is that China’s weak economy remains a huge wild card, especially with no signs of relief from the country’s “zero Covid” policy that is placing a huge damper on everything from consumer demand to logistics capabilities.

INDUSTRY

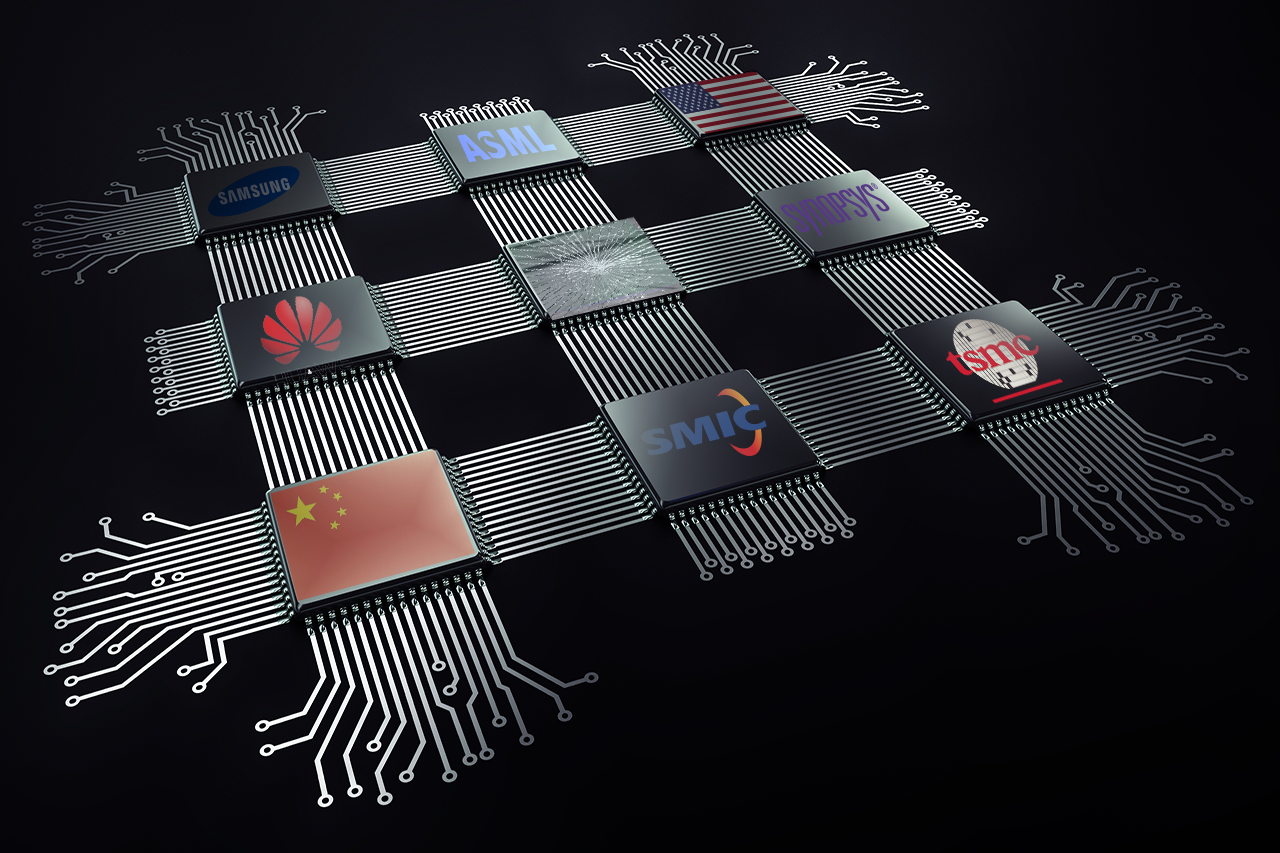

Chips for None

The biggest industry news last week was easily new restrictions announced by the U.S. against Chinese chip makers, the latest move by Washington to stifle China’s chip-making ambitions. The policy targets U.S. companies that sell sophisticated machinery used to make microchips to Chinese buyers, forcing the former group to obtain special licenses to continue selling to China.

Up until now, most U.S. actions were directed at specific companies like Huawei and SMIC, aimed at stifling their rises. But this latest move shows Washington intends to take a broader approach, which many are predicting could significantly slow the progress of a sector that China desperately wants to develop. Not surprisingly, Chinese semiconductor chips didn’t react well to the development.

Plenty of ‘Unverified’

Stifling China’s chip sector wasn’t the only thing on Washington’s mind this week, as the U.S. Commerce Department also added the names of around 30 Chinese companies to an “unverified” list it maintains. Companies are added to the list when U.S. inspectors can’t verify what they are doing with sensitive technologies imported from the U.S., and inclusion on the list can ultimately result in the loss of a company’s ability to procure those products.

The “unverified” list is different from another “entity” list maintained by the Commerce Department, which prohibits any company from receiving U.S. technology unless the U.S. supplier gets special government permission. In a sign that Washington is slightly flexible, it did remove one Chinese company, WuXi Biologics, from the “unverified” list last week after U.S. inspectors were allowed to visit the company and confirm it was engaged in legitimate uses of the technology it was importing.

Bye Bye, Crypto

Most of us probably thought that crypto trading was finished in China after Beijing outlawed it about a year ago. But it seems a few crypto trading apps had managed to stay available in the country’s app stores. Not anymore, however, as China has officially booted out 13 crypto trading apps that were still accessible to local Chinese.

China is famous for its iron-fisted control of its app stores, which consist of Apple’s app store and dozens of smaller locally owned shops catering to Android phone users. But with thousands or even millions of apps to police and thousands more being added all the time, it seems these 13 crypto apps had managed to swim below the radar – until now.

COMPANY

The Ant That Disappeared

Leading corporate headlines from the past week was the mysterious disappearance of Ant Group from the Shanghai government’s list of high-tech firms eligible for local for tax breaks and fiscal subsidies. A notice on the government website that oversees this list explained that Ant was removed for failing to meet spending requirements for R&D.

This disappearance follows the much bigger disappearance of Ant from financial markets back in 2020, when the company’s blockbuster IPO that could have become the world’s biggest of all time was pulled at the 11th hour. Jack Ma, who founded both Ant and e-commerce giant Alibaba, has also done his own disappearing act in the last few years, in the ongoing fall from grace for one of China’s most prominent internet names.

Exceptional Chips

Back on the subject of chips, the U.S. has given industry giants Samsung and TSMC one-year exemptions from the big ban on sales of U.S. chip-making equipment to China-based companies. Samsung hails from South Korea and TSMC is based in Taiwan, but both companies have extensive chip-making operations on the Chinese mainland.

This particular move isn’t unexpected, since Samsung and TSMC are both already global chip-making leaders and are hugely important in the supply chain for leading-edge chips. But it does show there’s plenty of gray area when we talk about China’s chip industry, which is really a hodgepodge of both domestic and also foreign companies producing semiconductors on the Chinese mainland.

One Less Merchant

Our streak of several weeks without any major new corruption cases has been broken with news that the former president of China Merchants Bank has been booted from the Communist Party for “severe breaches of discipline.” As usual, there is very little detail on the latest case involving Tian Huiyu, though we’re sure to hear more about the vast sums of money he stole or was bribed with during his tenure as the case develops.

This particular story is notable because China Merchants, while state-run, is one of China’s most entrepreneurial banks and enjoys a relatively strong reputation both among businesses and investors. Tian’s fall from grace doesn’t necessarily mean the bank is at any major risk, though it’s definitely a black mark against its otherwise strong reputation.

AND FROM THE PAGES OF BAMBOO WORKS

| Xiaomi Becomes Poster Child for China-India Tensions Last week we featured a look at smartphone maker Xiaomi’s growing troubles in India, where nearly $700 million of its assets have been frozen amid a high-profile tax dispute. It’s far from clear that Xiaomi is blameless in this matter, as Chinese companies often have a reputation for playing fast-and-easy with things like tax laws to their own advantage. But it doesn’t require much digging to see that Xiaomi, India’s top smartphone brand, is just one of a growing list of Chinese companies being manhandled by Delhi. Other smartphone makers including Huawei, Oppo and Vivo have all faced similar accusations, which may be the result of alarm in Delhi over the rapid dominance of India’s smartphone market by Chinese brands in a relatively short period of time. |

| Go, Jay, Go! We’ll end our weekly wrap on a lighter note by spotlighting our preview of a Hong Kong IPO that’s a sort of mouthpiece of Jay Chou, one of Asia’s most recognizable pop stars known for his pouting looks and laid-back style. The IPO candidate, Star Plus Legend, doesn’t actually count Jay as one of its major investors, though its shareholders include some of his biggest fans like his mother and longtime manager. The company looks like a bit of a one-hit wonder, since its business relies almost exclusively on Jay and also the “Modong Coffee” product he made popular with his hugely successful “J-Style Trip” video in 2020. This IPO probably isn’t for serious investors since the company isn’t too big and its business isn’t that diverse. But his millions of fans might still find it an entertaining way to follow the 43-year-old singer as his long career heads into its twilight. |