China High Speed Transmission Faces Profit Lull as Core Wind Power Business Slows

Company reported record revenue last year, but the sharp gains were undercut by a decline in its core net profit

Key Takeaways:

- China High Speed Transmission’s core wind power and industrial gear businesses disappointed last year despite a policy environment that favored the company

- The company formed a major equity tie-up with an asset manager last year, raising cash as it searches for new business opportunities

By Lau Ming

A strong tailwind fills all sails, to slightly modify an old saying. That should certainly be the case for wind power companies in China, which should be big beneficiaries of Beijing’s push into renewable energy as it tries to achieve peak carbon emissions by 2030 and carbon neutrality by 2060.

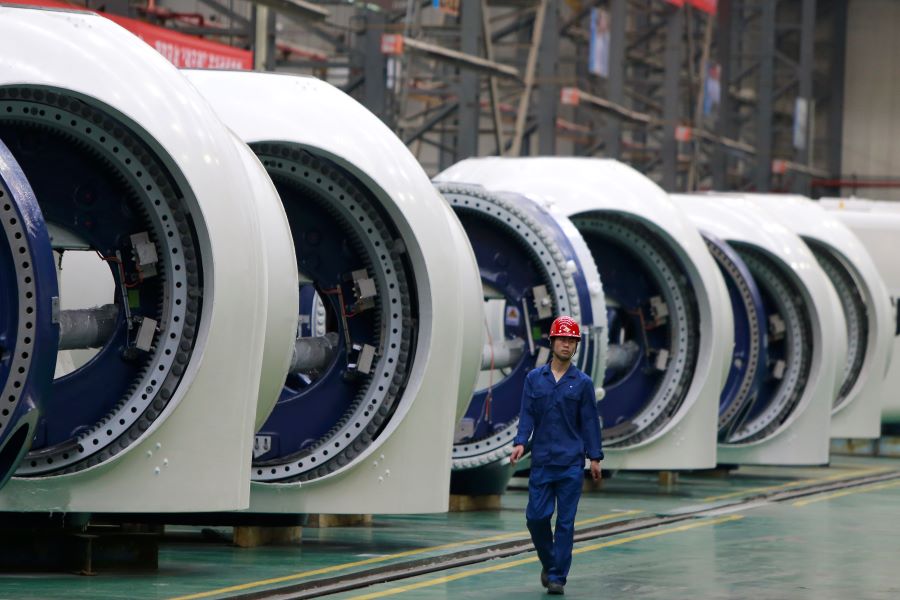

But the argument seems to fall flat for China High Speed Transmission Equipment Group Co. Ltd. (0658.HK), a wind energy equipment supplier that has run into headwinds that left it sputtering last year, according to its annual results released last week. Faced with cutthroat competition and rising costs, the company sold some of its operations to a major asset manager, hoping their combined resources and networks would bring new business opportunities and breathe some fresh air into its turbines.

China High Speed Transmission is a leading Chinese supplier of wind power transmission equipment whose customers include well-known wind turbine manufacturers such as GE Renewable Energy and Siemens Gamesa Renewable Energy. On paper, at least, things look just fine and dandy for the company. Its revenue increased 31.5% last year to a record 20.2 billion yuan ($3.2 billion), and its net profit rose 56.4% to 1.32 billion yuan.

But in 2020 the company incurred a one-time expense of 548 million yuan related to boosting the capitalization of one of its units. Adding that back to its reported net profit would bring the figure up to 1.39 billion yuan for the year, meaning the 2021 profit figure would mark a 5.3% decline.

The reasons behind its profit decline are hidden in its income structure. Its big revenue rise came mostly from progress for its new business operations. The company started commodity and steel supply-chain trading operations in the latter half of 2020, which posted 5.76 billion yuan in revenue last year – up 216.9% year-on-year and accounting for 28.5% of its total revenue.

Revenue for its industrial and rail transportation gear transmission equipment business increased by 27.4% and 23.5%, respectively, contributing a relatively small 9.6% and 1.8% of total revenue. By comparison, its core wind gear transmission equipment business slowed last year to just 3.3% growth, reaching 12.04 billion yuan, even as it accounted for around 60% of total revenue.

Low margin business

Commodity trading is a lucrative revenue source, but is a relatively weak profit contributor due to its low gross margins. It only accounted for 4.7% of the company’s operating profit last year, whereas wind and industrial gear transmission equipment contributed nearly 90%.

But falling prices for its wind and industrial equipment, combined with rising costs, and a growing share of revenue generated by its less-profitable trading business caused the company’s overall gross margin to tumble by 5.1 percentage points to 15.8% for the year. Rising geopolitical tensions and consequent surges in energy and raw material prices since early this year are likely to further push up costs and squeeze the company’s gross margin.

Investors aren’t oblivious to the company’s troubles. After the release of its financials late on March 6, its stock price plummeted 9.6% the next day to HK$5.38 and fell by a further 5.2% the day after that before finally recovering some ground. It has lost nearly 40% of its value compared with last April when its stock traded at a yearly high of HK$8.36.

According to data from the Chinese National Energy Administration, China added installed wind power capacity of 47.57 GW to the grid in 2021, up 34% from a year earlier. A big part of that was for offshore wind, as wind farm builders scrambled to snap up remaining government subsidies that expired at the end of 2021. As a result, installations for offshore wind capacity rose by 4.5 times last year from 2020 levels.

China’s central government will no longer subsidize new wind power projects going forward, and wind-generated electricity will be priced the same as coal-generated power. As a result, the industry is switching to high-power wind turbines to improve economic returns. To facilitate that move, China High Speed Transmission is actively developing high-power gear boxes, which partly led to a 30.2% jump in its R&D costs last year to 670 million yuan.

Cashing up its coffers

To replenish its coffers for tougher times ahead, the company last year sold 43% of its Nanjing High Speed Gear Manufacturing unit to a consortium organized by the resource-rich and experienced Shanghai Wensheng Asset Management. The subsidiary mainly manufactures and sells gears, gear boxes and other components, and posted a 796 million yuan profit in 2020.

China High Speed Transmission owned 93% of the unit before the sale, and it contributed over half of the parent company’s core net profit in 2020. The stake sale netted China High Speed Transmission around 3.5 billion yuan, which it will use to build new factories, upgrade production equipment and expand its trading business.

In addition to boosting cash flow, the sale has the added benefit of bringing in Wensheng Asset Management as a partner. Wensheng’s website shows it had a total of 123.2 billion yuan in assets under management by the end of 2021, and it is one of the country’s leading private managers of non-performing assets.

Wensheng’s investment marks a show of support for China High Speed Transmission, and could be followed by more resources and investment opportunities if the partnership goes well. China High Speed Transmission’s board believes that Wensheng’s strong investment background will help garner investor confidence and bring more resources and investment opportunities to both the Nanjing subsidiary and the company as a whole.

Leading Chinese wind power equipment makers Xinjiang Goldwind (2208.HK) and Dongfang Electric (1072.HK) offer good valuation comparisons for China High Speed Transmission. The two have price-to-earnings (P/E) ratios of 10.4 times and 9.7 times, respectively, based on their estimated profits for last year. Both are roughly double the 5 times P/E ratio for China High Speed Transmission, which looks relatively attractive at that level. But the sale of the Nanjing subsidiary, slowdown of its core wind power business and rising costs, are all good reasons why the company is valued less highly than its peers.

To subscribe to Bamboo Works free weekly newsletter, click here