Clarity Medical Eyes Mainland Market from Its HK Base in IPO Run-up

The private eye surgeon counts Wuxi Apptec as its No. 3 investor as it gears up for a Hong Kong listing

Key takeaways:

- Clarity Medical is aiming to raise up to HK$410 million through a Hong Kong IPO, as it prepares to expand from its Hong Kong base into the Chinese mainland

- The company specializes in refractive treatments, but its dependence on a small number of doctors is a major vulnerability

By Molly Wen

The massive China market may lead many to salivate at the chance of selling to its 1.4 billion consumers. But a huge 600 million subset of that who suffer from nearsightedness is also attracting the eyeballs of a growing field of ophthalmological specialists, including Clarity Medical Group Holding Ltd. (1406.HK), which has filed to make an IPO in Hong Kong.

The huge number of nearsighted Chinese has created a market worth tens of billions of dollars for corneal refractive therapy, which changes curvature of the cornea to fix problems including nearsightedness, astigmatism and farsightedness. Clarity Medicalisjust the latest in agrowing number of private Chinese ophthalmological institutions to tap the financial market since early last year, banking on strong demand for its eye surgery.

Founded in 2005 and currently confined to Hong Kong, Clarity Medical accounted for 5% of the local market for its services in 2020, making it the fourth biggest player. It provides a full range of services such as refractive therapy, cataract surgery, and basic physical checkups, and also sells prescription drugs.

After submitting three IPO applications to the Hong Kong Stock Exchange, it finally got the green light and kicked off its listing on the last day of January with plans to issue 136 million shares and raise up to HK$410 million ($53 million). The subscription will close on Feb. 10, with an estimated trading debut on Feb. 18.

After its IPO, the company will focus on entering the massive mainland China market. According to data cited in its prospectus, mainland China’s refractive therapy market is expected to grow at a compound annual rate of 14.4% between 2020 and 2024 and reach 64.7 billion yuan ($10.2 billion) by the end of 2024, which explains why the company is setting its eyes so squarely on the market.

Big-name investors

Two of Clarity Medical’s top investors are seasoned medical veterans that can provide invaluable assistance for its mainland expansion. One is 3W Partners, a private equity firm with rich experience investing in the industry, and which currently holds 44.21% of the company’s shares. The other, Wuxi Apptec (2359.HK), its third-largest investor, is a globally leading contract research organization (CRO) with 20.83% of the company’s shares.

Clarity Medical CEO Andrew Wong said at an IPO press conference that his company was previously exploring tie-ups with Wuxi Apptec. Those were held back by the pandemic, but are set to soon resume once the company launches its drive into the mainland market.

The company also intends to expand its business portfolio by swallowing up some mainland eye clinics, according to the prospectus. Around 35% of the funds raised will be used for buying one or two clinics in South China’s Greater Bay Area that includes Hong Kong. An additional 14.7% will be used to set up clinics with mainland business partners.

But the going in China won’t be easy due to a crowded and competitive field already in the market. A leading player is Aier Eye Hospital (300015.SZ), which is valued at 174.5 billion yuan and has over 600 facilities across China. One of Clarity Medical’s hometown rivals, C-MER Eye Care (3309.HK), entered the mainland market a long time ago and currently has 12 clinics there. Clarity Medical first floated the idea of entering the mainland as early as during its first IPO attempt in 2019. But three years on, it has not unveiled any substantive initiatives in that direction.

The company is focused on a small and clearly-defined business scope of providing refractive therapies to patients with nearsightedness, farsightedness and astigmatism. It should continue to enjoy strong demand from a new generation of teenagers suffering from nearsightedness caused by excessive smartphone and computer use, and watching too much TV.

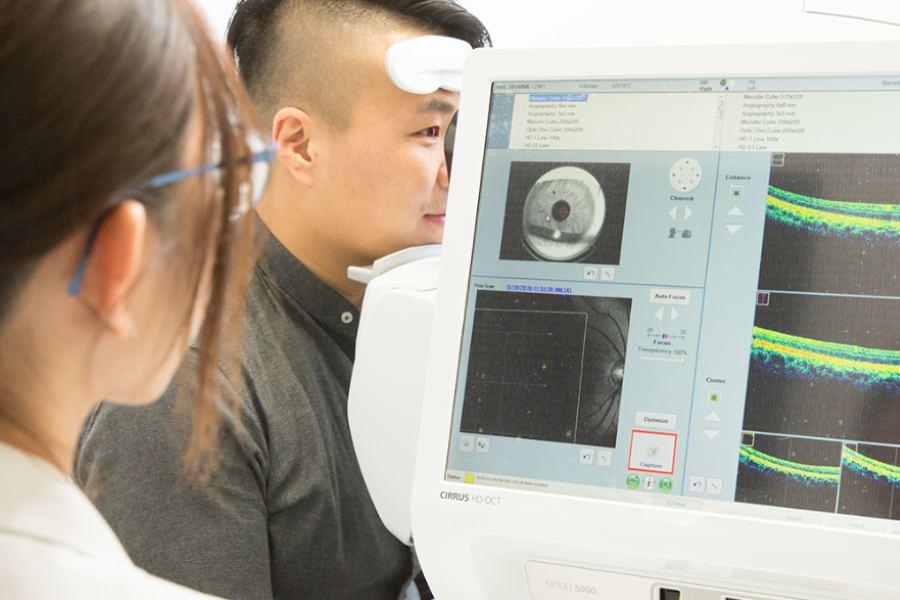

Refractive therapies contribute more than 70% of the company’s revenue. SMILE surgery is its signature product, using a state-of-the-art technique to correct nearsightedness and astigmatism. Its incisions are smaller and less likely to cause dry eyes compared with a popular earlier procedure called LASIK. During the 12 months ended March 31 last year, the company made HK$220 million in revenue, with HK$100 million of that from SMILE procedures.

Clarity Medical was one of Hong Kong’s earliest private institutions to use imported equipment for SMILE operations. The price for having the operation on both eyes is HK$28,000, representing a huge markup from the cost to the company of HK$2,000 to HK$2,500 per eye.

The company ranked first in terms of earnings from SMILE operations in Hong Kong in 2020, taking up 38% of the market. It was followed by C-MER Eye Care and Hong Kong Laser Eye Center with 18.4% and 13% market share, respectively. A Frost & Sullivan report cited in the prospectus points out the SMILE market will increase in value from HK$260 million in 2020 to HK$990 million in 2025 as potential patients become better informed about the treatment.

Small doctor pool

Despite its strong growth prospects, Clarity Medical’s heavy dependence on a few doctors makes it financially vulnerable. In the 2021 fiscal year, the company generated approximately HK$220 million in revenue, up just 2% from the previous year, of which HK$160 million or 62.6% came from just three doctors out of the 10 on its payroll last year. Two are shareholders, and one of those, who alone accounts for 38.4% of its revenue, is retained by the company on a consultant contract that does not preclude him from working for competitors. Coupled with the fact that his patient base is growing by 20% annually, the loss of that doctor would be major blow to the company.

Clarity Medical’s profit for the year ended March last year was HK$35.77 million, up 36% year-on-year. The company has set the initial range for its IPO shares at HK$1.60 to HK$3 each, with the middle of that range gives it a P/E ratio of around 32 times. C-MER Eye Care’s P/E stands at a whooping 246 times P/E ratio, calculated using its earnings for the first half of last year. But when compared with 17.2 times and 79.9 times P/E ratios for Chaoju Eye Care (2219.HK) and Aier Eye Hospital, Clarity Medical’s valuation is in the middle of the pack.

While C-MER Eye Care and Chaoju Eye Care had cornerstone investors that presubscribed for around 40% of their IPO shares, Clarity Medical has yet to announce any such investors, leading to lukewarm sentiment toward the listing. By Feb. 3, it had secured just HK$19 million from subscribing brokerages, and only 46% of the shares made available to public investors had been snapped up, a sign that investors are sitting on the fence.

To subscribe to Bamboo Works free weekly newsletter, click here