Dingdong Pulls Further Away From Old Opponent, But Profits Remain Far Off

Online grocery giant left its top rival Missfresh in the dust in terms of third-quarter revenue, but its losses keep growing as it pursues more customers

Key points:

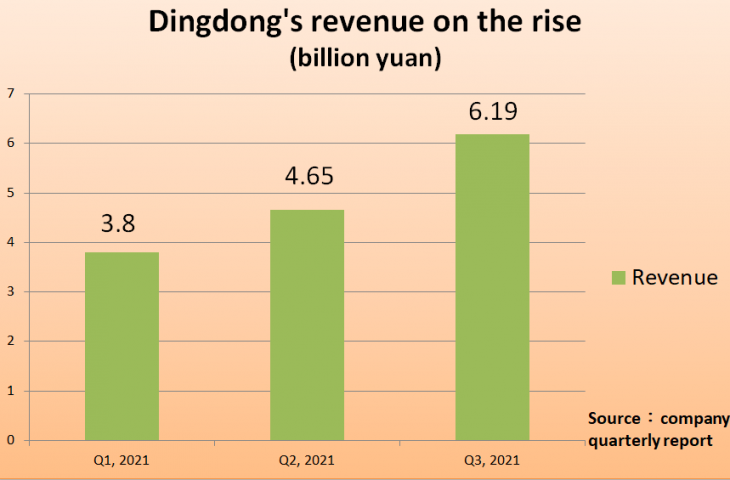

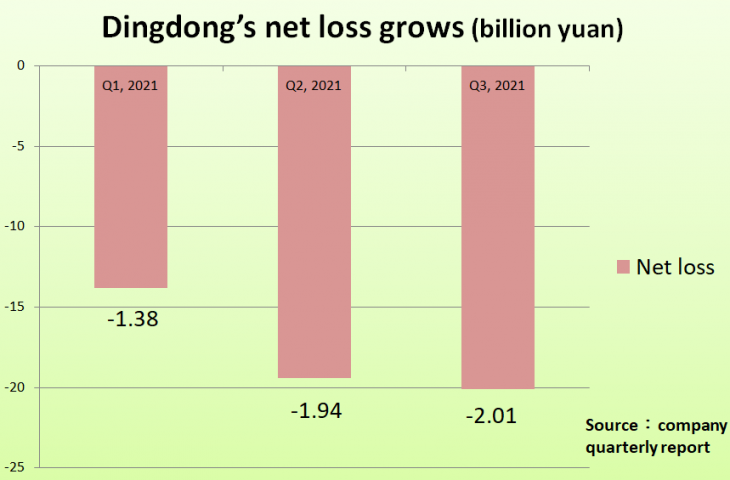

- Dingdong’s revenue doubled in the third quarter, but its loss grew even faster by 1.4 times as it become trapped in a cycle of ‘greater losses with more income’

- The company’s management admitted returns on investment are still a long way off

By Jony Ho

Multiple Covid-19 outbreaks have made Chinese consumers increasingly accustomed to buying groceries online. The race for supremacy in that fast-growing space was on display in the latest quarterly results that continued to show market leader Dingdong Ltd. (DDL.US) pulling away from one of its top rivals, Missfresh Ltd. (MF. US).

Dingdong’s revenue grew much faster than Missfresh’s, even as the former is still clearly in the “money burning” phase. Reflecting that, Dingdong’s losses in the latest quarter alone were almost equal to Missfresh’s entire revenue for the period. Reversing the cycle of “more income equals greater losses”, has become an urgent issue for Dingdong, even as its management admitted such losses could still last for a while to come.

Dingdong’s latest earnings report published this week showed its revenue doubled to 6.19 billion yuan ($960 million) year-on-year in the third quarter, which was in line with the company’s previous guidance. By comparison, Missfresh’s quarterly revenue grew by a far slower 47% to 2.12 billion yuan in the same period, making it only about one-third of Dingdong’s size, according to its separate report released last week.

While Dingdong increasingly looks like it has clearly defeated its major opponent, its aggressive money-burning pushed its quarterly loss to 2.01 billion yuan, up from the second quarter, and representing a 142.7% increase year-on-year. Missfresh recorded a loss of 974 million yuan as well, though the figure marked an improvement from the previous quarter.

After providing discounts to existing customers who recommend new ones, Dingdong’s sales and marketing expenses tripled to 428 million yuan during the quarter, resulting in 107% growth for its gross merchandise volume (GMV) for the period.

Monthly active users (MAU) for Dingdong’s mobile app in September also ranked first among e-commerce grocery companies, giving it a coveted seat among China’s top 10 e-commerce companies, according to QuestMobile data.

Dingdong is also spending heavily on research and development, whose costs tripled year-on-year to 257 million yuan. The company explained that such heavy spending is aimed at improving efficiency to reduce operating costs for its vast supply chain system that often extends from where food is grown to where it is finally eaten. It is also spending heavily on agricultural technology to enhance its upstream partners’ capabilities.

The backbone of Dingdong’s business model is a national network of self-operated mini-warehouses to bring fresh food from rural areas to urban customers. By comparison, rivals such as Meituan (3690.HK) and Pinduoduo (PDD.US) use a decentralized model that relies on suppliers and warehouse operators to perform most of the tasks.

The result is that Dingdong’s expenses are relatively high, with its cost of goods sold reaching 5.06 billion yuan in the third quarter – accounting for more than 82% of its revenue during the period.

Dingdong founder and CEO Liang Changlin explained on the company’s earnings call that its non-GAAP net loss rate in the third quarter dropped by 5.3 percentage points from the previous quarter, exceeding the group’s target of 4 percentage points. “It mainly benefited from investment in the whole supply chain, including contract agriculture, agricultural technology, direct procurement, private label and food processing,” he said.

Liang said he expects the company will achieve better improvement in the fourth quarter than the third, while admitting that it may still be a long time before it can reap harvests from its many investments.

Shanghai at the Fore

Chief Strategy Officer Yu Le added the company expects to break even first in Shanghai, where it began its earliest operations. From there it will aim to achieve similar operating profits throughout the surrounding Yangtze River Delta region.

While management was optimistic about the company’s prospects, investors weren’t completely convinced. After announcing its latest results, the company’s stock price sank 10.13% on Tuesday and closed at a three-week low of $26.27, well below its historic high of $46. The stock is still about 12% above its listing price of $23.50 from its June IPO.

Credit Suisse wrote that Dingdong’s profit margin improved in the third quarter as its revenue growth accelerated. Even in the company’s more mature Yangtze River Delta region, GMV grew as much as 64.8% year-on-year, meaning Dingdong still has huge room for growth in cities where it already operates through incremental expansion.

Increased order density in cities where it already operates and the investment in other parts of the industry will help to improve the company’s capabilities, Credit Suisse added. Accordingly, it was optimistic about the company’s profit prospects in the Yangtze River Delta region, estimating Dingdong’s loss per share will come down by up to 6% annually between 2021 to 2023. It has a current target price for the company of $35.

Going upstream for profits

While the report seemed to praise Dingdong, a closer examination paints a slightly different picture. In particular, mid-single-digit declines in Dingdong’s loss per share over the next two years seems to imply the company will face difficulties making a profit in the short term.

It’s already difficult for fresh food e-commerce companies, whose business spans agriculture, production, warehousing, logistics and retail, to make profits. To increase its gross profit margin, Dingdong has invested upstream and launched higher value-added products, such as branded pre-prepared dishes and standardized packaged pork, targeting a share of the upstream profits those products generate. The effectiveness of that strategy has yet to be seen.

For now, we know the company has grown bigger and is now a clear leader in the vast China market. Whether it can turn losses into profits and end its counterproductive cycle of “more income, greater losses” remains to be seen.

To subscribe to Bamboo Works free weekly newsletter, click here