Facing Strict Regulation and Falling Profits, Is Qingci’s IPO Untimely?

The mobile game company currently relies on just two titles, notably ‘The Marvelous Snail’ for most of its revenue, leading to volatile finances

Key Takeaways:

- Qingci Games has priced its Hong Kong IPO at the bottom of its range, raising $122 million

- Company’s valuation looks relatively pricey when compared with peers

By Jony Ho

Hong Kong is welcoming its first mobile game listing of the year with Qingci Games Inc. (6633.HK), as 2021 looks set to go down as a year of tightening internet regulation in China, including growing oversight of online games. Qingci commands a modest 0.4% market of China’s gaming market. But that’s still enough to rank it 20th in the country as the company’s IPO comes into the final stages.

Despite the gaming market’s volatility, Qingci’s stock has been aggressively priced, resulting in sluggish sentiment towards the offering. Analysts believe the company will continue to be at the mercy of regulators in the near-term. Its strong reliance on a single game for the majority of its revenue is also further weighing on sentiment towards the company.

Based in the southern city of Xiamen in Fujian province, Qingci is issuing 85 million shares. It completed the offering last Thursday and trading will begin this Thursday. Market sources said the offering has received a lukewarm response, reflected by a large cancellation of shares ordered using margin financing. In the end, the public portion of the offering may only be oversubscribed by a low single digit times amount, leading the shares to price at HK$11.20, representing the low end of their range. That allowed the company to raise about HK$952 million ($122 million).

Founded in 2012, Qingci’s prospectus notes that its games are popular with people aged 30 or younger, particularly among leisure and rogue-style role-playing gamers. Leisure games are often simple, requiring players to only perform basic operations to generate in-game currency and manage automated operations. The rogue-style games are a subgenre of the larger RPG category.

The company currently operates six mobile games, with another 10 in reserve. Among those, the iconic “Marvelous Snail” game is easily Qingci’s biggest breadwinner, contributing 400 million yuan ($63.7 million) in revenue in the first month after its launch in June 2020. It generated 1.17 billion yuan in its first seven months, accounting for 95.3% of last year’s revenue.

New games in the wings

In the “risks” section of its prospectus, Qingci admitted that most of its revenue comes from just a few games like “Marvelous Snail,” with much of the company’s revenue growth in the first half of this year coming from the title. But a natural peak and subsequent decline that’s routine for all games will ultimately have a negative effect on its business and operating results, the company said.

As “The Marvelous Snail” matures, its revenue growth has slowed and its ranking on the China iOS game bestseller list has dropped from second place in 2020 to sixth place in the first half of this year. Related revenue from the title in the first half of 2021 fell 55.9% to 516 million yuan when compared with the second half of 2020, accounting for 67.7% of the company’s total.

Fortunately, Qingci has another game on the rise to pick up the slack. Launched in March this year, “Lantern and Dungeon” brought in 229 million yuan for the company in the first half of the year, providing some timely relief to “Marvelous Snail’s” slowdown.

A mobile game’s life cycle typically has three stages: growth, maturity and decline. Among Qingci’s six titles in operation, “The Marvelous Snail” is moving from the growth stage to the maturity stage, with revenue declining as a result. “Lantern and Dungeon” is in the growth stage. The other four games are between the maturity and declining stages, with modest revenue of 198,000 yuan to 10.46 million yuan each in the first half of year, representing just a tiny part of the company’s total.

All this reflects the heavy reliance on just a handful of individual games by small- to medium-sized companies like Qingci, forcing them to continually innovate to keep their revenue cycle healthy.

But can “Lantern & Dungeon” take the place of a “Marvelous Snail”? The outlook isn’t great in that regard, as Qingci expects its operating profit to drop significantly in the second half of the year, mainly due to lack of new releases and the maturation of its current two hit titles.

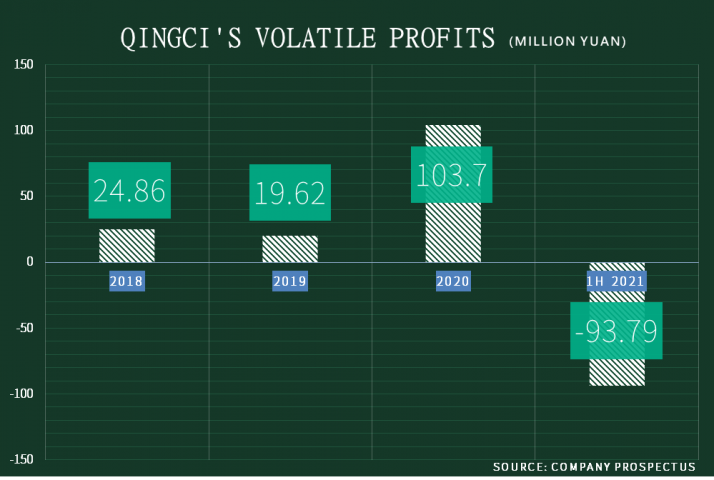

Like other small- to midsized game operators, Qingci’s earnings are relatively volatile due to product cycles. In 2018 and 2019, it reported net profits of 24.9 million yuan and 19.6 million yuan, respectively. It initially recorded a 156 million yuan loss in the first half of 2020, but “Marvelous Snail” came to the rescue and it ended up with a 104 million yuan profit for the year – a 4.3 times increase from the previous year.

But the group swung back into the red in the first half of this year, posting a 93.79 million yuan loss as “Marvelous Snail” revenue declined and, more importantly, it recorded a 338 million yuan loss based on a change in value of preferred shares.

Supported by three giants

By now readers may be starting to realize that Qingci’s decision to go public might be timed to cash in before its performance declines with the fading of “Marvelous Snail.”

Equally worrisome are the effects that China’s changing national policy might have on the company. The Chinese National Press and Publication Administration, one of the industry’s main regulators, issued a notice in August limiting minors to just three hours of online gaming per week. Although such minors have less money to spend on games than adults, the limits are almost certain to put a damper on spending.

Qingci’s attraction lies partly in its recent strong show of support from some of China’s top internet companies. In April the company received about 300 million yuan in a pre-IPO strategic investment from leading game company Tencent Holdings Ltd. (0700.HK), joined by e-commerce giant Alibaba Group Holding Ltd. (9988.HK; BABA.US) and online video company Bilibili Inc. (9626.HK; BILI. US). A month later the trio and Boyu Capital each purchased additional new Qingci shares worth 101 million yuan, and Qingci applied for its listing. Before the IPO, Tencent, Alibaba, and Bilibili each held about 5% of Qingci’s shares, while Boyu Capital held 1.87%.

Because its earnings are volatile, price-to-earnings (P/E) ratios are also volatile and not a good way to compare Qingci with its peers. Instead, a price-to-sales (P/S) ratio makes a better gage. Assuming a consistent performance in the second half of the year, Qingci’s revenue for the entire year will come in at 1.52 billion yuan, or about HK$1.86 billion.

Based on the IPO price of HK$11.20, the company would have a market capitalization of about HK$7.67 billion and a P/S ratio of about 4.1 times.

Using a similar calculation, the projected P/S ratio for another mid-sized game company CMGE Technology Group Ltd. (0302.HK) is only about 1.7 times; iDreamSky Technology Holdings Ltd. (1119.HK) is about 2.5 times; and IGG Inc. (0799.HK) is even lower at 1.1 times.

The only peer with a higher valuation is Archosaur Games Inc. (9990.HK), with a forecast P/S of 5.2 times. Thus, Qingci’s valuation based on P/S isn’t cheap.

Ryan Chan, Associate Director of Eddid Securities and Futures Ltd., said he believes China’s strict limits on underage gaming won’t be relaxed in the near term, meaning companies like Qingci that focus on younger gamers will be more affected.

“As the Hong Kong IPO market is cold and strict official regulation continues, Qingci’s IPO is quite untimely from a fundamentals point of view,” he said.

Chan added he believes the outcome of its share allotment could determine whether Qingci’s shares fall below their IPO price when trading begins. A smaller allotment for small investors would benefit the stock price, he said. But if a majority of the shares go to small investors, who are famously fickle and looking for quick profits, the stock could well come under pressure on its debut.

To subscribe to Bamboo Works weekly newsletter, click here