Sea Cucumber Breeder Anyuan Makes Second Go at Hong Kong Listing. But Will Investors Bite?

Leading sea cucumber breeder’s profits are declining as it faces challenges of competition and growing reliance on small number of major buyers

Key takeaways:

- Sea cucumber breeder Anyuan Marine’s profits are declining as it makes its second attempt to list in Hong Kong this year

- Investors may eschew the stock after the recent scandal involving another seafood breeder Zoneco Group

By Jony Ho

They may be small, but the lowly sea cucumber could still translate to big bucks with the potential to nurture a business worth billions. Leading Chinese sea cucumber breeder Anyuan Marine Breeding Co. Ltd. certainly hopes that’s the case, following its application for a listing in Hong Kong on the last day of November. That marked the second time Anyang has applied for a listing in Hong Kong this year, following an initial one in May that later expired without any movement.

Sometimes called sea slugs, sea cucumbers are bottom dwelling creatures mostly disdained by western palettes but considered a delicacy by many Chinese. The industry catering in such creatures has always found a profitable business among such local diners, spawning a number of large enterprises worth billions of dollars and an industry with more than 1,000 breeders.

While seemingly niche, the market is notable for its growth potential. According to a forecast by market research firm China Insights Consultancy (CIC) cited in the Anyuan’s IPO prospectus, the value of China’s sea cucumber aquaculture industry will grow from 20.8 billion yuan ($3.28 billion) in 2015 to 30 billion yuan in 2020, translating to compound annual growth of about 7.6%.

Despite taking a hit at the beginning of 2020 when the global pandemic began, China’s catering market has rebounded as the country bought its outbreak under control. As that happened, the sea cucumber market is expected to resume growth at a compound annual rate of 7.2% over the next four years, making it worth 42.4 billion yuan in 2025.

No. 1 in China

Anyuan has three production bases in coastal Shandong and Liaoning provinces, encompassing about 101,900 cubic meters of water for sea cucumber breeding. The company ranked first in sea cucumber breeding in terms of its water body and sales, according to the CIC report. But its share of the market was only about 5.4%, reflecting the industry’s high degree of fragmentation.

While Anyuan is the industry leader, it faces three major worries for investors.

The first is volatile finances. Its prospectus shows that Anyang’s revenue is on an upward track, growing from 167 million yuan in 2018 to 214 million yuan last year, and 114 million yuan in the first half of this year. If it maintains that performance, its annual income this year will reach 228 million yuan, up from last year.

But its pre-tax profit has moved in the opposite direction, dropping from 112 million yuan to 106 million yuan over the last three years, and on track to fall further still this year with a 49.77 million yuan profit in the first half of 2021. That shows the company’s profitability has been declining despite its growing sales.

Reflecting that, the group’s return on total assets has dropped from 27.7% to 17.1% in the last three and a half years, and its return on equity has also dropped from 31.1% to 20%. In short, the company’s good ol’ days of selling sea cucumbers for fat profits have sunk out of view.

Unusually high temperatures in the summer of 2018 in Liaoning led to mass deaths of sea cucumbers, resulting in price hikes of more than 50% that benefited breeders like Anyang. But when supplies returned to more normal levels, both prices and profit margins dropped.

In its prospectus, Anyang cited its inability to always price its products at intended profit margins due to reduced bargaining power or changes in market conditions as a risk factor that could adversely affect its business. The first half of this year is a case in point, with the average price of juvenile sea cucumber down 33.8% year-on-year, mainly due to the larger numbers of smaller sea cucumbers as a percent of the total.

Small customer base

Anyang also faces the challenge of relying on a small group of customers for a big part of its business. Between 2018 and 2020, its five largest customers accounted for 40.3%, 59.6%, and 57% of its revenue, respectively. While those customers have relationships dating anywhere from one to eight years, Anyang pointed out there is no guarantee they will continue to maintain the same level of cooperation. What’s more, such customers may also demand more discounts due to their big buying.

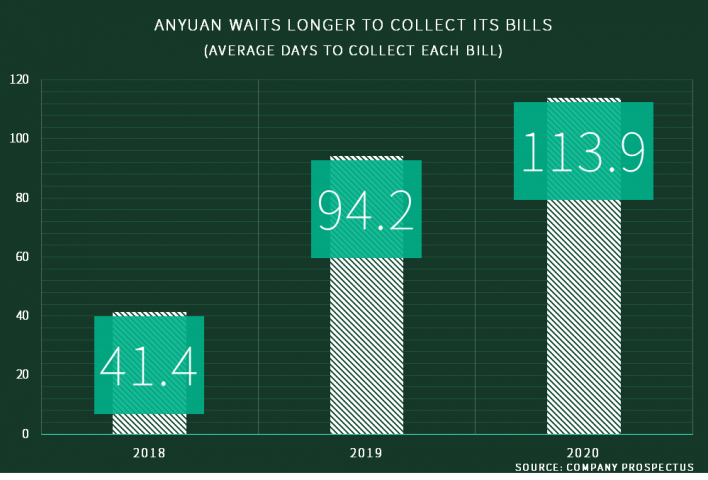

The third concern is the lengthening period for Anyang to collect its bills, which it attributes mainly to growing sales to two strategic customers in Liaoning with longer settlement cycles. The company’s average trade receivables turnover days nearly tripled from just 41.4 in 2018 to 113.9 days in 2020. At the same time, its outstanding trade and other receivables has also increased from 35 million yuan to 100 million yuan, also undermining its finances.

Less apparent than those three concerns, market confidence could also be a worry. Does anyone out there remember Zoneco Group Co. Ltd. (002069.SZ)? The cultivator of seafood, such as scallops and abalone, was a hit with investors when it listed in Shenzhen and became known as the “first seafood share” in China. But enthusiasm began to wane after it repeatedly claimed losses over the last few years for a number of reasons, including accidents such as escapes, disappearances and collective deaths due to reasons like abnormal water temperatures, reduced precipitation, and even warmer-than-usual weather.

Smelling something fishy, the China Securities Regulatory Commission conducted its own investigation over potential illegal disclosure and non-disclosure of important information. Zoneco was later warned and fined last year, with senior managers deemed to be involved in the illegal activities subjected to legal sanctions

Affected by the scandal, Zoneco’s stock has dropped from a high of 12.17 yuan over the last five years to just 2.08 yuan at the beginning of last year, losing nearly 83% of its market value.

Of course, Anyuan is a completely separate company. But investors don’t always see things that way, meaning it’s quite possible they could spurn another major seafood seller like Anyang.

Because its listing is in the very initial phases, Anyang has yet to give a share price, or even the number of shares it plans to issue and predicted market value. But we can get a potential valuation by looking at some of its peers.

Shanghai-listed Shandong Homey Aquatic Fishing Co. Ltd. (600467.SH) is closest to Anyuan in terms of business. That company’s profit in the first three quarters of this year was about 58 million yuan, which would translate to a full-year profit of about 77 million yuan. On that basis, Homey would have a forecast price-to-earnings (P/E) ratio of about 51 times.

Among other China-listed aquaculture companies, Fujian Tianma Science and Technology Group Co. Ltd. (603668.SH) and Guangdong Haid Group Co. Ltd. (002311.SZ) have similar P/E ratios of 54 times and 52 times, respectively. Zoneco, CNFC Overseas Fisheries Co.Ltd. (000798.SZ) and Zhanjiang Guolian Aquatic Products Co. Ltd. (300094.SZ) are all losing money, and thus have no P/E ratios.

Using its after-tax profit of 37.26 million yuan in the first half of the year and assuming a stable performance in the second half, Anyuan would have a profit this year of about 74.5 million yuan. Thus a P/E ratio of 50 times would give it a market value of around 3.8 billion yuan, or about $600 million.

Its three negative factors and broader recent weakness for Hong Kong stocks could mean Anyuan may be valued at a slight discount to its peers. But only time will just how much of a discount will whet investor appetites.

To subscribe to Bamboo Works free weekly newsletter, click here