ZhongAn Subtly Touts Its Investment Chops Without Help of Big-Name Parent

Online insurer’s investment income has grown solidly even as it reduces its reliance on Ping An Insurance to manage its assets

Key takeaways:

- ZhongAn Insurance says it renewed an asset management services agreement with Ping An Insurance, one of its three parents

- While the cap on fees ZhongAn can pay to Ping An annually was unchanged in the new agreement, the company hasn’t fully utilized the quota in recent years

By Warren Yang

As ZhongAn Online P&C Insurance Co. Ltd. (6060.HK) matures into a force in its own right, China’s first online-only insurer is subtly asserting its independence from one of its three main shareholders, industry heavyweight Ping An Insurance (2318.HK; 601318.SS).

Last Friday, ZhongAn, which was created in 2013 as a joint venture between Ping An and internet titans Alibaba (BABA.US; 9988.HK) and Tencent (0700.HK), said it renewed an asset management service agreement with Ping An Asset Management for three years beginning Jan. 1. Under the plan, which runs through the end of 2024, ZhongAn will pay Ping An as much as 160 million yuan ($25.2 million) in service fees each year. That annual cap remains the same as the prior two years, after being doubled in 2020 from the previous 80 million yuan.

Such asset management agreements can be helpful for small insurers that don’t have sufficient resources to place their own investments. Insurers invest large parts of premiums they collect from customers in financial instruments like stocks and bonds. Services from large asset managers can help generate better returns, but fees eat into profit.

In fact, however, ZhongAn has never come close to reaching the cap in its Ping An agreement lately. It paid Ping An fees totaling about 75 million yuan in 2019, less than the 80 million yuan cap for that year. The following year it paid about 109 million yuan, far short of the then-new ceiling of 160 million yuan, according to the Friday disclosure. The figure for 2021 is set to drop substantially, given that the sum for the first 11 months of the year was just 58.8 million yuan.

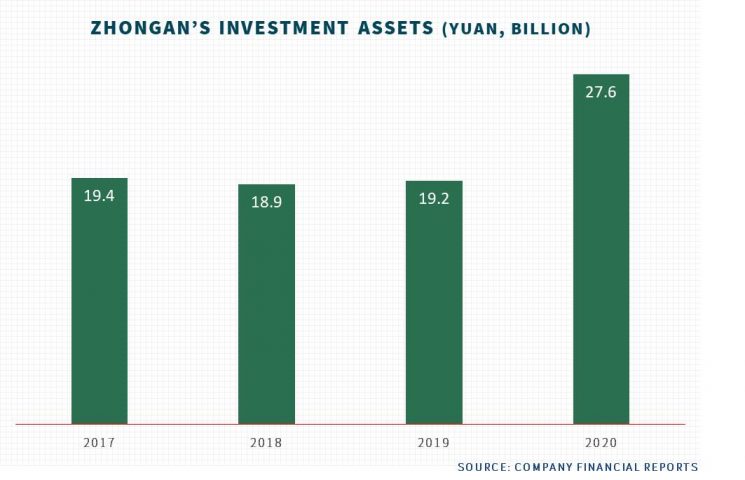

ZhongAn also said the amount of assets to be managed by Ping An will remain similar in 2022 compared to last year. Although the company didn’t provide a specific figure, this means the proportion of assets managed by Ping An in ZhongAn’s total investment portfolio will probably shrink since the overall portfolio will continue to expand. ZhongAn’s total investment assets swelled 44% at the end of 2020 from a year earlier, and grew another 9% in the first six months of last year.

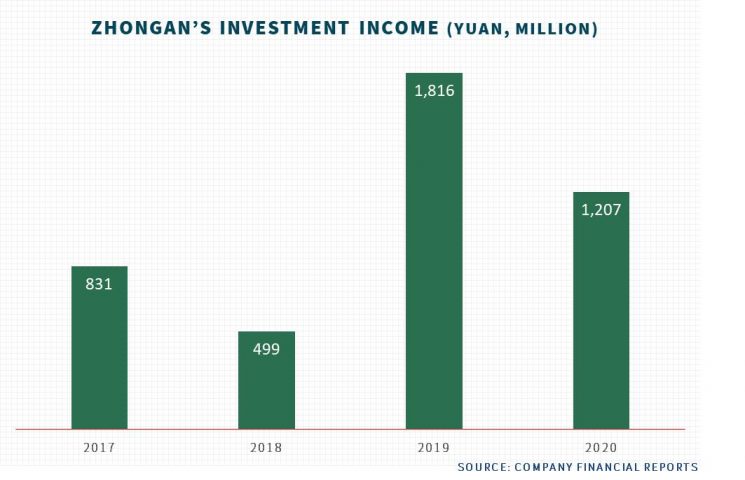

Similarly, fees that ZhongAn pays to Ping An as a proportion of its overall investment income likely dropped last year. Fees payable to the insurance giant for the first 11 months of the year equaled only 0.6% of ZhongAn’s investment income in the first six months. That’s already down from about 0.9% for all of 2020 and looks set to decline further when investment gains in the second half are added.

The bottom line is that ZhongAn’s reliance on Ping An for assistance in managing its assets is already quite small and getting smaller.

ZhongAn has come a long way since being created to much fanfare by its high-profile founders as a pioneer in so-called insurtech. Its total assets grew more than 70% in the two years to the end of 2020, with revenue nearly doubling over that time. In 2020, it made its first-ever annual profit, and it achieved another first in the first half of last year by logging its first profit from underwriting insurance.

The latter feat is noteworthy because ZhongAn competes in an industry dominated by state-owned heavyweights and deep-pocketed financial conglomerates. The online insurer carved out its own niche by introducing unique, low-cost products, such as plans that pay for shipping costs when products need to be returned, while continuously expanding its offerings spanning auto and health insurance.

Symbolic underwriting profit

Despite posting its first insurance underwriting profit in the first half of last year, that profit was tiny and more symbolic than substantial. There’s also no certainty that insurance underwriting will be consistently profitable for ZhongAn. That’s partly because the company relies heavily on third-party partners to sell its products, meaning it has to pay out a larger share of revenue from insurance sales in fees to those partners, including Alibaba and Tencent.

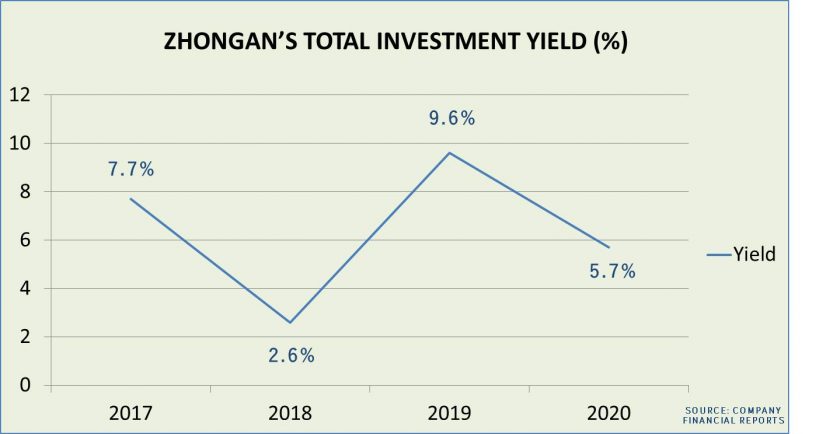

That means investment income will remain the main driver of ZhongAn’s net profit. In the first half of 2021, investment income grew a solid 25% from a year earlier. The total investment yield held steady at 3.8% on a non-annualized basis, although returns on a net basis declined to 1.3% from 2%.

As creative as ZhongAn is with product development, it’s rather conservative when it comes to its own investments. As of the end of June, about 36% of its investment assets were in fixed-income instruments, which entail relatively low risks. Only about 20% was in equities, including unlisted ones, which often offer better yields but carry higher risks.

The “other investments” category of ZhongAn’s portfolio accounted for about a quarter of the total, the bulk of that in wealth management products. Some such investment schemes in China are notorious for being opaque and risky. But based on the modest overall yield for all of its investments, ZhongAn, as a more sophisticated institutional investor, is likely staying away from such speculative products that promise high returns.

ZhongAn has been adjusting the allocation of its investment assets over the years. The current composition of its portfolio may be aimed at providing greater stability than in the past, helping to curb income swings that were sometimes large in previous years.

All this shows ZhongAn is doing just fine in asset management without much help from Ping An. The company may also need to prepare for more separation from its other two parents – Alibaba and Tencent – as Chinese regulators pressure the internet giants to divest assets to curb their dominance in a range of sectors. Last month, Tencent divested most of its stake in JD.com Inc. (JD.US), the second largest online retailer in China. And Alibaba is reportedly in talks to sell its stake in Weibo (WB.US; 9898.HK), the Chinese equivalent of Twitter.

For now, ZhongAn isn’t in the same category of household names like JD and Weibo. But if it keeps growing, it may eventually become too big for Alibaba and Tencent to own without raising regulators’ eyebrows.

ZhongAn is currently quite reliant on Alibaba and Tencent platforms for its business. In the first half of last year, it paid almost 750 million yuan to the pair in fees for product distribution and technical services, about 18% of the total operating expenses for its insurance business.

Chinese internet stocks have fallen out of favor with investors these days as the nation’s regulators broaden their crackdown on technology companies. ZhongAn shares haven’t been exempt, losing more than half of their value since their market debut in 2017.

Even so, the stock currently trades at a price-to-earnings (P/E) ratio of 39, much higher than multiples for traditional insurers. Ping An trades at a far more modest P/E ratio of 7. ZhongAn’s ratio is also well above those of other fintech companies in China, such as a paltry 1.8 for LexinFintech Holdings Ltd. (LX.US) and 5 for Lufax Holding Ltd. (LU.US), which have been directly hit by Chinese regulators’ efforts to rein in online lenders.

That suggests that investors are more optimistic about ZhongAn’s prospects than other fintechs. And ZhongAn is proving it can be more than a gimmicky offspring that has made headlines because of its big-name parents.

To subscribe to Bamboo Works free weekly newsletter, click here